Reimagining the global (re)insurance value chain

Aydin Betez, Executive Director, UK Head of Commercial & Specialty Insurance, Capco

The global (re)insurance industry is at a crossroads, with advances in AI creating a clear first mover advantage in terms of efficiency enhancement and competitive advantage for organizations that embrace modernization.

Across the (re)insurance sector, the forces of consolidation, digital competition, and regulatory demands are squeezing margins and increasing complexity. Meanwhile, clients increasingly expect organizations to offer levels of transparency immediacy and personalization on par with digital banking and ecommerce.

The imperative is no longer about whether to modernize, but rather how fast and how smartly. Organizations must move from fragmented, post-M&A estates to integrated, data-driven, and AI-ready operations. Targeted investments that create value today and future-proof the enterprise should be prioritized, as should a forward-facing strategy spanning technology, data and AI that links transformation to business growth and resilience.

Three levers for growth and a new North Star

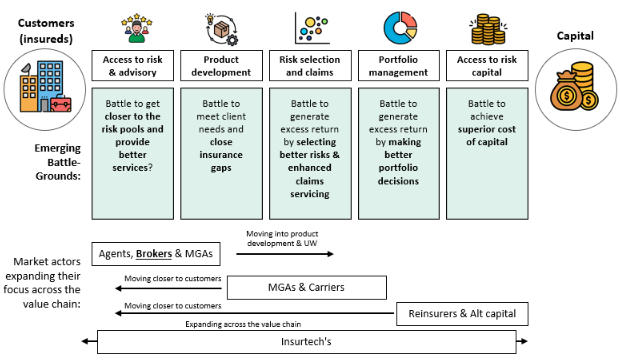

Leading organizations within the insurance sector are capturing more of the value chain and deepening client relationships through three strategic levers.

Value chain compression. Positioning differentiated underwriting and distribution models to own product and profit, accessing diverse sources of capacity for faster market entry, and partnering across the (re)insurance ecosystem to scale programs.

Value optimization. Streamlining and automating operations to lower cost, boost agility, and reinvest in innovation.

Global cross-selling. Expanding revenue per client through broader solutions and data-led insight.

These levers are transforming (re)insurance economics and delivering higher margins, faster product innovation and smarter, data driven pricing.

Figure 1 illustrates the current and future battleground that is taking shape across the (re)insurance value chain.

Figure 1

Organizations are building underwriting and capital platforms to capture more of the (re)insurance value chain.

- US MGA premiums reached about $115B in 2024, growing around 15% year-on-year.

- Over 1,000 MGAs now operate in the US alone, with a growing share independent of carriers.

- Lloyd’s capacity via MGAs reached roughly $8B, shifting toward smaller and mid-size syndicates.

The AI-Infused Enterprise

Our vision allows firms to unlock immediate efficiencies, strengthen resilience and secure a leadership position in an AI-driven market, building on five connected pillars.

- Consolidate and modernize platforms – build a unified, scalable foundation that integrates placement, claims, and servicing:

• Rationalize legacy estate and identify consolidation opportunities; migrate to cloud platforms; build an integration layer connecting placement, claims and servicing in real time; automate workflows and standardize data models to harmonize operations. - Treat data as a product – manage data as a governed, reusable enterprise asset powering insight and growth:

• Implement a modern data platform integrating structured and unstructured data; assign data owners and create domain-specific product teams; build APIs and data products for self-service analytics and AI enablement; deploy lineage tracking, validation rules and monitoring dashboards. - Redefine the client journey – deliver connected, personalized digital experiences:

• Build a single digital layer connecting multiple channels and core platforms; enable real-time tracking of policies, renewals and claims; deploy analytics to personalize interactions and predict client needs; apply design thinking and accessibility principles for intuitive user journeys. - Strengthen operational resilience – embed proactive risk management, cyber security and regulatory alignment:

• Build strategic capability to go beyond compliance and drive growth through resilience by design; manage supply chains with stronger third-party oversight, monitoring, and reporting; integrate risk and resilience through aligned frameworks and end-to-end operating models; strengthen cyber resilience by embedding security and rapid recovery into the business. - Infuse artificial intelligence – embed AI across underwriting, placement and claims to enhance speed, accuracy and productivity:

• Identify high-value use cases in placement, claims and support functions; deploy copilot tools and digital agents to augment daily workflows; build predictive models for renewal, pricing, and claims outcomes; create MLOps pipelines for training, deployment and monitoring; embed ethics and transparency controls within every AI deployment.

These pillars collectively establish a streamlined intelligent operating model: unified at its core, human centered in design, and trusted by clients, partners, capital providers, and regulators alike. This model aligns with the ongoing reshaping of (re)insurance economics and serves to strengthen market resilience via higher margins, faster innovation, smarter pricing and greater flexibility.

The AI-infused path to reinvention

The (re)insurance industry is moving beyond incremental change toward structural reinvention. The winners will be interoperable, intelligent, and insight driven, connecting human expertise with digital precision to serve clients and partners faster and more transparently. With embedded AI, trusted data, and resilient systems, organizations can finally unlock a model that is efficient, agile and deeply client-centric while strengthening the long term health of the global (re)insurance ecosystem.

Sign Up to TINsights

Where we share our latest blogs, industry reports and insights