A summary report of the main drivers for automating claims processes, and the perception of the business case for doing so.

Summary

In Spring 2022, The Insurance Network and Endava conducted a claims practitioner survey to establish what progress the UK insurance sector is making in automating claims, what the main drivers are for automating claims processes, how the business case is perceived (and articulated), and what practitioners see as the key challenges in applying automation in claims. These questions, and the results of the survey, were discussed at a virtual roundtable on May 25th that sought to explore those drivers and challenges and share some learnings around strategies for successful implementation. This report summarises the survey findings and discussions at the virtual roundtable, which was held under The Chatham House Rule.

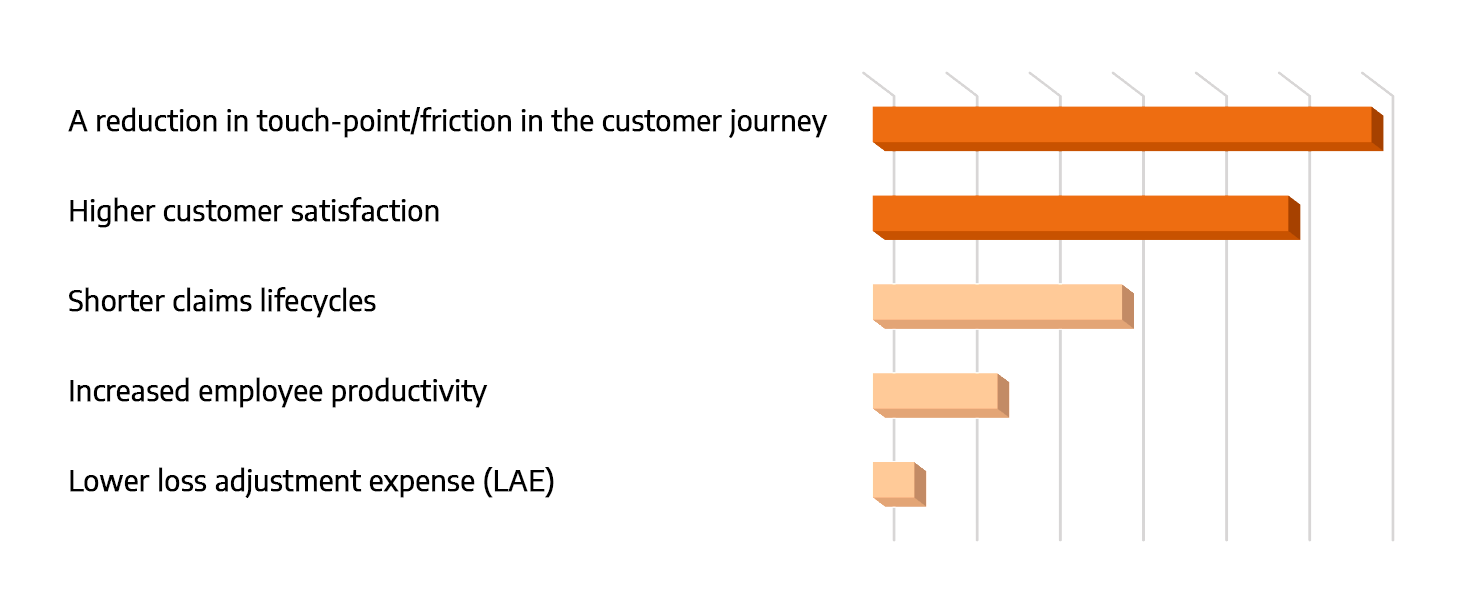

What are the key drivers for automating all or part of the claims journey?

The survey asked what the key drivers for claims automation are. It is clear that the focus for automation projects has shifted away from cost reduction or efficiencies towards improving customer experience and the claims journey. The two highest ranking answers were “a reduction in touch-points / friction in the customer journey” (with more than a 3rd of respondents placing this top of the list of key drivers) and “higher customer satisfaction” (just under a third), with “increased employee productivity” and “lower loss adjustment expense (LAE)” ranking bottom.

Drivers for automating the claims journey

This was generally not the case pre-pandemic when most participants in the virtual roundtable agreed efficiency was the main metric. This echoed comments made by survey respondents:

"Customer service and making processes more streamlined is a significant driver for improved digital journeys

We see digital as the opportunity to simplify the claim experience, removing complexity and effort for customers, leading to increased satisfaction

with the process, the outcome and the time to settle. Similarly, staff experience can also be improved."

However, respondents were keen to stress that the two are not mutually exclusive, and in fact have become more intrinsically linked as digitisation and automation play a bigger role in claims:

"A reduction in touch points should lead to faster processing with fewer errors, meaning reduced expense and shorter lifecycles.

Automating the claims process leads to less ambiguity as information is interpreted more consistently. We do see a cost saving on opex but this is not the biggest driver. Creating fantastic friction-less claims self-service journeys is my priority which will naturally have ...

To continue reading, click here

Sponsored by:

[advert-4]

Sign Up to TINsights

Where we share our latest blogs, industry reports and insights